Antjuan Wyatt and his wife recently closed on a three-bedroom, 1,500-square-foot house in a leafy, middle class Detroit neighborhood.

The house needs some work -- new furnace, new plumbing, new windows. But that's OK, because Wyatt bought the place at auction for $1,000.

"We were looking for a home in the suburbs, but the prices were too high," said 27-year old Wyatt, who works at a local Chrysler plant and dabbles in real estate on the side. "I was surprised I got this for $1,000."

In four months (and $30,000 in repairs), Wyatt hopes he can move into the refurbished gem with his wife and their two kids.

Wyatt bought his home through a new program run by the Detroit Land Bank, an entity charged in early 2014 with addressing the huge number of vacant homes in the city. While some cities struggle to find innovative ways to build new housing, Detroit struggles to manage the homes in place.

The problem is hard to overstate. In the early 1950s, 1.8 million people lived in the city. Last year, the population was 700,000.

"We have housing stock for over a million people who don't exist anymore," said David Szymanski, chief deputy treasurer in Wayne County, which includes Detroit. There are currently 80,000 dilapidated properties in Detroit and 100,000 empty lots -- a third of the city's total. Tens of thousands more homes face foreclosure.

America's most innovative cities

The county tries to auction these homes, but it doesn't always work, said Szymanski. Of the 30,000 homes auctioned in the last three years, owners of 22,000 didn't pay property taxes. This lack of tax revenue is a main reason why Detroit can't keep the lights on and the streets clean, which leads more people to leave the city, which leads to more foreclosed and eventually abandoned homes.

In many cases, the taxes aren't paid because unscrupulous landlords or speculators would intentionally let the county foreclose, and then just buy the house back at auction for a fraction of what was owed in back taxes.

The county is trying to fix this, and has enacted a rule allowing a home to be seized if it isn't torn down within six months or improved within two years of purchase.

The greatest urban projects of all time

The land bank is trying to avoid this altogether. Its auctions only let people buy one home a month -- discouraging speculators and developers. They also require that buyers not owe any back taxes or have any housing code violations.

"We want people moving into them, we want families moving into them," said Craig Fahle, a land bank spokesman. "That's what's going to reestablish the real estate market in this town."

The idea is to get more people into homes like Kate Daughdrill, who bought a three-bedroom house at a county auction in 2011 for $600.

Daughdrill, 29, has since bought seven other vacant lots around her house, and now runs an urban farm in addition to working as a visual artist. The first year after she bought her home, she raised a pig and traded the meat for electrical work.

While Detroit's population is still declining, these cheap homes have proven popular with creative types like Daughdrill, who can then spend more time on their passion and less trying to pay the rent. Equally important is the chance to help with the rebuilding of Detroit.

"When people are present and show care for a home, they can transform that home and that whole block," she said. "Having a presence starts that shift."

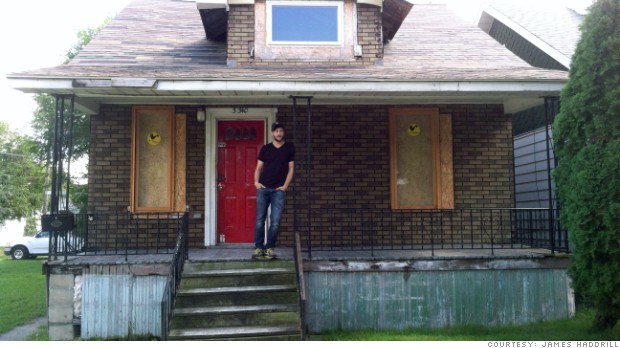

James Haddrill, a 35-year old sculptor who grew up in the Detroit suburbs, bought a three-bedroom house a block away from Daughdrill at a 2011 county auction for $500. When he bought it, it was being used as a crack house.

James Haddrill in front of the hosue he bought for $500

James Haddrill in front of the hosue he bought for $500"It was filled with clothes, couches, mattresses," said Haddrill, who evicted the occupants himself and now uses the house primarily as a studio. "Cleaning it was one of the craziest experiences of my life."

All these people said buying a home through the land bank or the county was a relatively easy process. Haddrill suggested they market the program to artists in other cities -- like New York -- where space is becoming prohibitively expensive.

Wyatt said city offerings -- especially the schools -- will have to get a lot better before more people move to Detroit.

Both the county and the land bank are marketing these homes, but buyer interest will have to grow quickly if they want to avoid even more vacant buildings -- the county is set to foreclose on a record 80,000 homes in 2015.

What's innovative about your city? Let us know by posting your photo and description to #CNNCities on Instagram.